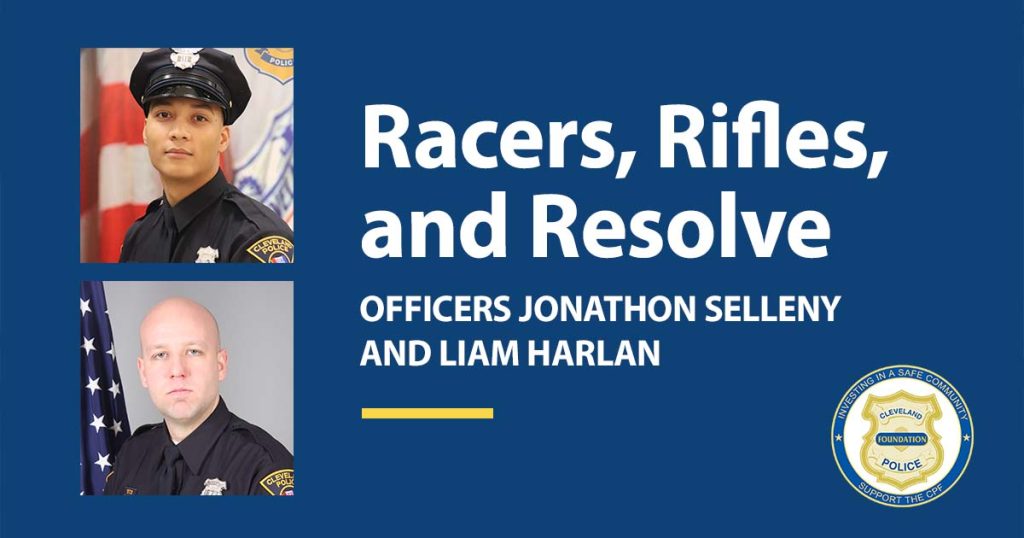

This past September, Third District Patrol Officers Jonathon Selleny and Liam Harlan were awarded the Special Commendation Award at the Third District Community Relations Awards Ceremony. The following is the scenario behind this well-deserved recognition:

On May 26, 2024, Patrol Officers Selleny and Harlan responded to a radio call reporting drag racing in a school parking lot. This location was known to the officers as a frequent site for illegal street racing, reckless stunts, and numerous citizen complaints. Upon arriving, they observed dozens of vehicles driving recklessly.

As the officers arrived, the vehicles began dispersing. While on the scene, they heard gunshots coming from within the parking lot. Despite the large number of vehicles and the dangerous circumstances, Officers Selleny and Harlan successfully stopped one of the vehicles as it attempted to leave the lot.

Approaching the vehicle, they immediately noticed the buttstock of what appeared to be an assault rifle between the two males inside. Acting swiftly, they detained the suspects and confirmed the weapon was fully loaded and ready to fire. Both individuals were arrested, and the rifle was confiscated.

The exceptional work of these officers ensured dangerous criminals and weapons were removed from the streets, making the neighborhood safer for all.

It is because of their commitment to the Cleveland Division of Police and the community they serve that the Cleveland Police Foundation is proud to name Patrol Officers Jonathon Selleny and Liam Harlan as our Police Officers of the Month for December 2024.

– Bob Guttu, CPF

_

The Cleveland Police Foundation is the official charity for the Cleveland Division of Police and the only organization authorized to solicit charitable contributions on its behalf.

We provide funding for youth and community outreach programs, community policing and engagement initiatives, safety & crime prevention programs, and support the members of the Cleveland Division of Police to help them better perform their duties. Contributions to the CPF are tax deductible under section 501 (c)(3) of the IRS Code.

Thank you for supporting the mission of the CPF.